Withholding rates by country can be found here. Cross-check the info on the IRS website.

Due to the new AdSense rules as of June 1st, 2021, every creator who receives income from the platform must enter their tax data into their AdSense account. After that, AdSense will determine the tax that the creator must deduct to the US monthly.

As you know, we give you the opportunity to use the income earlier than it accrues to Google (express payments!). In order not to be confused in the withdrawal of obligations in the new conditions, we define all partners according to 3 types.

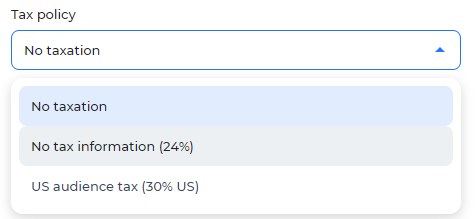

Type 1: obligations in Mediacube Pay come with a deduction of 5% of the creator's predicted earnings

Type 2: obligations in Mediacube Pay come with a deduction of 24% of the creator's predicted earnings, and then another minus 5% of the creator's share

Type 3: obligations in Mediacube Pay come with a deduction of 5% of the creator's predicted earnings, also deducted 30% of the share of the creator's income from the United States

Note: interest is charged only on credits!

At the end of each month, the real YouTube statistics come in and the accruals are recalculated.

To determine your type, we check the tax form in your AdSense. If it says you don't need to deduct anything, then you're type 1. If you need to pay tax - type 3. All new partners belong to type 2 until we check their tax form, so write to us and send us screenshots!