The KYC (Know Your Customer) procedure is a process of confirming (verifying) an identity using scans or photos of official documents.

According to generally accepted international standards, only verified users can conduct any transactions with money. Most often, to pass KYC, you need to upload documents confirming your identity and address of residence. This ensures companies that they’re not dealing with scammers, and users do not doubt the safety of their funds.

The KYC procedure is used by banks, exchanges, payment systems, and financial platforms.

Why is there KYC in MC Pay

MC Pay allows you to fully manage your income, keep money on your balance, withdraw it using convenient payment methods, and transfer it to other users. Therefore, in accordance with international practice, we must make the KYC procedure mandatory for our users.

Verification guarantees the security of all financial transactions. Thanks to KYC, we know for sure that we are paying money to the rightful owner of the account, and you can feel secure about the safety of your earnings. Only verified users can withdraw and transfer money.

How to verify a profile

There are 2 types of accounts in MC Pay – personal profile and company account. A company account is needed if you withdraw money to a legal entity.

The verification procedure is available to users only if one of the conditions in the profile is met:

1) Availability of funds on the balance;

2) Having a connected channel and managing it as the Primary Owner in the system.

Personal profile verification

To verify your profile, go to Settings.

Verification is passed in three stages:

1. Filling in legal data

2. Identity verification

3. Confirmation of residential address (Optional step)

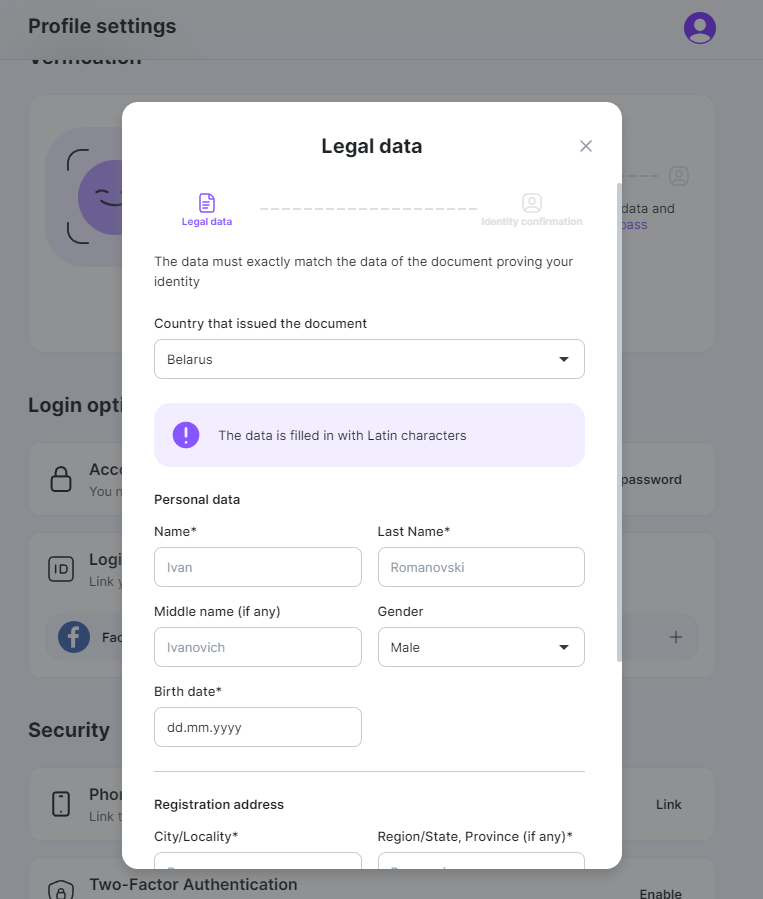

Legal data

The first stage of verification is confirmation of legal data. You must specify your full name, date of birth, and address of registration/residence. The data is filled in in Latin characters and must exactly match the information in official documents.

Citizens of Russia fill in the data twice – in Russian and in transliteration in Latin characters (Юлия – Yuliya, ул. Калиновского – ul. Kalinovskogo).

Identity verification

First you need to upload a scan or photo of a document proving your identity. It could be a:

passport,

ID card,

residence card,

driver's license.

Only scans and photos of original documents not edited in photo editors are accepted. Photos must be of good quality, taken on a neutral background, without glare, flash, and foreign objects in the frame, with well-read text.

Next, you’ll need something like a selfie. You need to look at the camera and make a circular motion with your head. The system will compare your image with the document photo to make sure it's really you.

We will check the legal information in the profile with the information in the documents, and you will be able to continue verification.

After passing the verification, you can manage your money.

Address confirmation (Optional step)

To confirm the address of residence, you need to upload a scan or photo of one of the following documents:

Passport page with registration address, if you live by registration

Bank statement

Utility bill

Rental agreement

The document must be no older than three months (does not apply to the passport page with the registration address).

If you are under 18 years old, additionally you need to upload

Parental consent. Contact your manager or technical support to get a form

Document proving your identity

Parent's identity document

Document confirming relationship

We accept scans and photos of original documents only (not copies). Photos must be of good quality, no flash, no foreign objects in the frame, with clear readable text. It is important that the edges of the document are clearly visible.

Documents are checked by our manager. If you uploaded a photo of poor quality or you need to clarify the data, the manager will leave a comment. We will send an email and a notification to your profile so that you know what the problem is and reupload the documents.

Company account verification

If you are going to withdraw money to a legal entity, you need a company account. Contact your manager or technical support, and your profile will be converted into a company account, an account of a legal entity. It needs to be verified.

The first stage of verification is filling in legal data. First you need to specify the data of the director. If the profile that was converted to a company account was already in the name of the director, just check if everything is correct. If the data of another person is indicated, replace them with the full name of the director. Next, you need to specify the company's data – registration number, taxpayer number, address of registration/actual location of the organization.

The second stage is the confirmation of the registration of the company. To do this, you need to upload scans or photos of these three documents (or equivalent to them in the country of registration of your company):

1. Certificate of the state registration

2. Certificate of directors, order and (or) minutes of the meeting on the appointment of a director

3. A document that confirms the address of the company, if it is not indicated in the documents above

Scans/photos must meet the following requirements:

Scan or photo of the original document only (not a copy)

The edges of the document are clearly visible, there are no foreign objects in the frame

Good quality photo, no flash, and readable text

Documents are checked by our manager. If you uploaded a photo of poor quality or you need to clarify the data, the manager will leave a comment. We will send an email and a notification to your profile so that you know what the problem is and reupload the documents.

After passing the verification, you can manage your money.